All Categories

Featured

Table of Contents

- – Innovative Private Equity For Accredited Inves...

- – Next-Level Accredited Investor Platforms

- – World-Class Accredited Investor Real Estate D...

- – High-Quality Accredited Investor Growth Oppor...

- – Elite High Yield Investment Opportunities Fo...

- – Trusted Accredited Investor Wealth-building ...

- – Reliable Accredited Investor Investment Fund...

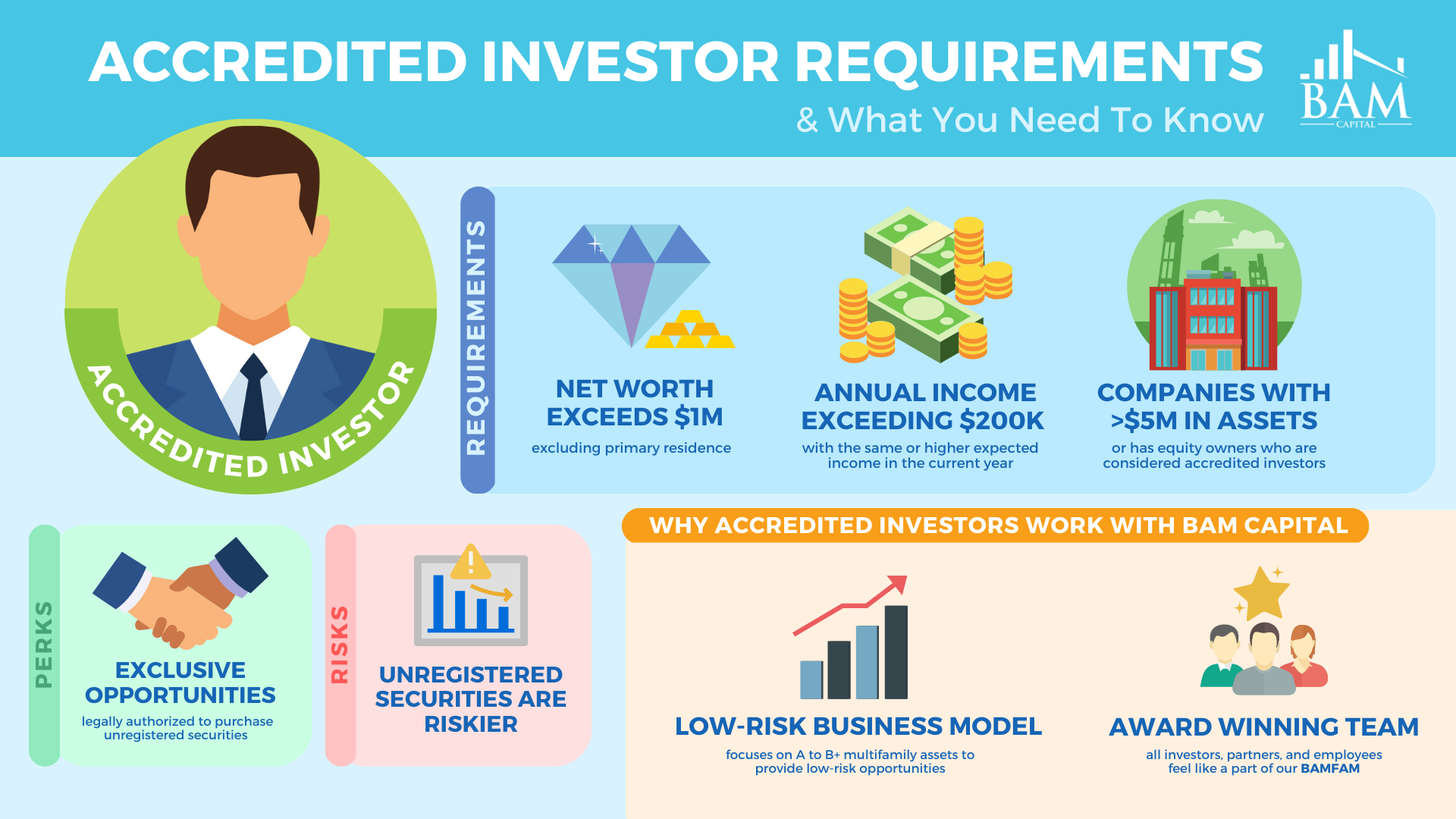

The regulations for certified capitalists vary amongst territories. In the U.S, the interpretation of a recognized investor is put forth by the SEC in Rule 501 of Policy D. To be an accredited financier, an individual has to have an annual earnings surpassing $200,000 ($300,000 for joint income) for the last two years with the expectation of earning the exact same or a higher earnings in the current year.

A recognized financier ought to have a total assets surpassing $1 million, either separately or jointly with a partner. This amount can not include a primary residence. The SEC likewise thinks about applicants to be recognized capitalists if they are basic partners, executive policemans, or directors of a company that is releasing non listed securities.

Innovative Private Equity For Accredited Investors for Exclusive Opportunities

If an entity is composed of equity owners that are recognized financiers, the entity itself is a recognized investor. Nevertheless, a company can not be developed with the sole objective of acquiring specific securities - accredited investor investment funds. An individual can qualify as a recognized financier by showing adequate education or task experience in the economic sector

People who wish to be approved capitalists don't use to the SEC for the designation. Rather, it is the duty of the business supplying an exclusive positioning to ensure that all of those come close to are approved financiers. Individuals or events who intend to be certified investors can approach the issuer of the unregistered protections.

As an example, intend there is a private whose income was $150,000 for the last three years. They reported a main house value of $1 million (with a mortgage of $200,000), a cars and truck worth $100,000 (with a superior loan of $50,000), a 401(k) account with $500,000, and an interest-bearing account with $450,000.

Net worth is determined as properties minus obligations. He or she's internet well worth is specifically $1 million. This includes a calculation of their properties (aside from their primary house) of $1,050,000 ($100,000 + $500,000 + $450,000) much less an auto loan equaling $50,000. Given that they meet the total assets need, they qualify to be a certified capitalist.

Next-Level Accredited Investor Platforms

There are a couple of much less usual qualifications, such as handling a depend on with more than $5 million in properties. Under federal safeties legislations, only those that are accredited capitalists might take part in particular safeties offerings. These may consist of shares in exclusive positionings, structured products, and private equity or hedge funds, among others.

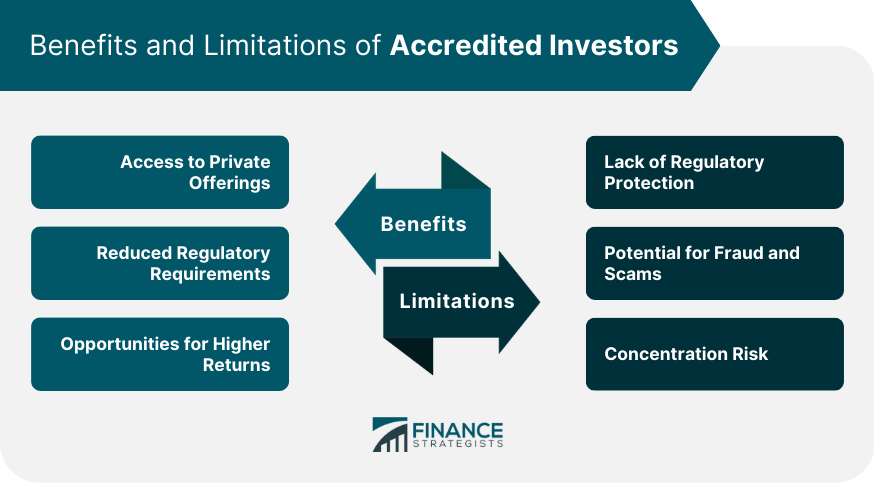

The regulatory authorities wish to be certain that individuals in these very high-risk and complex investments can take care of themselves and evaluate the dangers in the absence of government security. The recognized capitalist policies are developed to shield prospective investors with restricted monetary knowledge from high-risk endeavors and losses they might be ill equipped to stand up to.

Approved investors meet certifications and professional criteria to accessibility unique financial investment chances. Designated by the United State Stocks and Exchange Commission (SEC), they acquire access to high-return choices such as hedge funds, financial backing, and exclusive equity. These investments bypass full SEC enrollment yet lug higher threats. Accredited capitalists must satisfy earnings and total assets demands, unlike non-accredited individuals, and can spend without restrictions.

World-Class Accredited Investor Real Estate Deals for Accredited Investor Opportunities

Some crucial modifications made in 2020 by the SEC consist of:. Consisting of the Collection 7 Series 65, and Series 82 licenses or various other qualifications that reveal economic knowledge. This modification identifies that these entity types are commonly utilized for making investments. This adjustment acknowledges the know-how that these employees create.

These modifications expand the certified capitalist pool by approximately 64 million Americans. This bigger access offers much more possibilities for financiers, yet also enhances potential risks as less financially innovative, financiers can participate.

These financial investment alternatives are unique to accredited financiers and institutions that certify as a recognized, per SEC guidelines. This provides certified investors the possibility to invest in arising firms at a phase prior to they take into consideration going public.

High-Quality Accredited Investor Growth Opportunities

They are considered as financial investments and come only, to certified customers. Along with well-known firms, qualified financiers can pick to buy start-ups and promising endeavors. This provides them income tax return and the opportunity to go into at an earlier stage and potentially gain incentives if the company succeeds.

However, for capitalists available to the dangers included, backing start-ups can cause gains. Several of today's tech firms such as Facebook, Uber and Airbnb originated as early-stage startups sustained by certified angel investors. Sophisticated investors have the opportunity to explore investment choices that may produce a lot more earnings than what public markets provide

Elite High Yield Investment Opportunities For Accredited Investors

Returns are not guaranteed, diversification and profile improvement options are increased for investors. By expanding their portfolios through these broadened financial investment methods accredited financiers can enhance their methods and possibly attain superior long-lasting returns with proper danger management. Experienced capitalists commonly encounter investment choices that may not be quickly readily available to the basic capitalist.

Financial investment choices and safeties used to accredited financiers generally include greater risks. Personal equity, endeavor funding and bush funds commonly concentrate on investing in assets that lug threat but can be sold off conveniently for the opportunity of higher returns on those risky financial investments. Looking into before investing is critical these in situations.

Lock up durations protect against capitalists from withdrawing funds for even more months and years on end. There is likewise far much less transparency and regulatory oversight of personal funds compared to public markets. Investors might struggle to precisely value exclusive properties. When managing risks accredited financiers need to analyze any kind of private investments and the fund supervisors entailed.

Trusted Accredited Investor Wealth-building Opportunities

This adjustment might extend accredited financier standing to a series of individuals. Upgrading the income and possession benchmarks for rising cost of living to ensure they show adjustments as time progresses. The existing thresholds have stayed fixed since 1982. Allowing companions in committed relationships to combine their sources for shared qualification as certified financiers.

Enabling people with certain professional qualifications, such as Collection 7 or CFA, to certify as accredited financiers. This would certainly acknowledge economic refinement. Developing added demands such as proof of monetary proficiency or successfully finishing an accredited capitalist examination. This can guarantee investors understand the threats. Restricting or removing the main house from the internet well worth estimation to reduce possibly inflated evaluations of wealth.

On the other hand, it might additionally cause knowledgeable investors presuming too much dangers that might not be appropriate for them. Safeguards might be needed. Existing certified financiers might encounter enhanced competitors for the finest investment opportunities if the swimming pool expands. Companies raising funds might gain from an increased accredited financier base to draw from.

Reliable Accredited Investor Investment Funds for Consistent Returns

Those that are presently considered accredited investors have to stay updated on any type of alterations to the requirements and regulations. Businesses looking for accredited financiers need to remain vigilant about these updates to ensure they are drawing in the best target market of investors.

Table of Contents

- – Innovative Private Equity For Accredited Inves...

- – Next-Level Accredited Investor Platforms

- – World-Class Accredited Investor Real Estate D...

- – High-Quality Accredited Investor Growth Oppor...

- – Elite High Yield Investment Opportunities Fo...

- – Trusted Accredited Investor Wealth-building ...

- – Reliable Accredited Investor Investment Fund...

Latest Posts

Number Of Accredited Investors In The Us

First-Class Accredited Investor High Return Investments for High Returns

Accredited Investor Ipo

More

Latest Posts

Number Of Accredited Investors In The Us

First-Class Accredited Investor High Return Investments for High Returns

Accredited Investor Ipo