All Categories

Featured

Table of Contents

Capitalist with an unique legal status A certified or innovative financier is an investor with a special standing under monetary regulation laws. The interpretation of a certified financier (if any), and the effects of being identified thus, range countries - non accredited investors in hedge funds. Generally, certified capitalists include high-net-worth individuals, financial institutions, banks, and other huge firms, that have accessibility to complex and higher-risk investments such as venture capital, hedge funds, and angel investments.

It specifies innovative capitalists so that they can be treated as wholesale (rather than retail) customers., an individual with a sophisticated capitalist certification is an advanced capitalist for the function of Phase 6D, and a wholesale customer for the objective of Chapter 7.

A corporation included abroad whose activities resemble those of the corporations laid out above (non accredited investor real estate). s 5 of the Stocks Act (1978) specifies an innovative investor in New Zealand for the functions of subsection (2CC)(a), a person is wealthy if an independent chartered accounting professional certifies, no greater than 12 months before the deal is made, that the chartered accountant is pleased on affordable grounds that the individual (a) has web properties of a minimum of $2,000,000; or (b) had an annual gross income of a minimum of $200,000 for every of the last two financial years

"Spousal equivalent" to the certified financier definition, so that spousal matchings might merge their funds for the purpose of certifying as recognized financiers. Gotten 2015-02-28."The New CVM Instructions (Nos.

Apply For Accredited Investor

17 C.F.R. sec. BAM Capital."Even More Capitalists Might Get Access to Personal Markets.

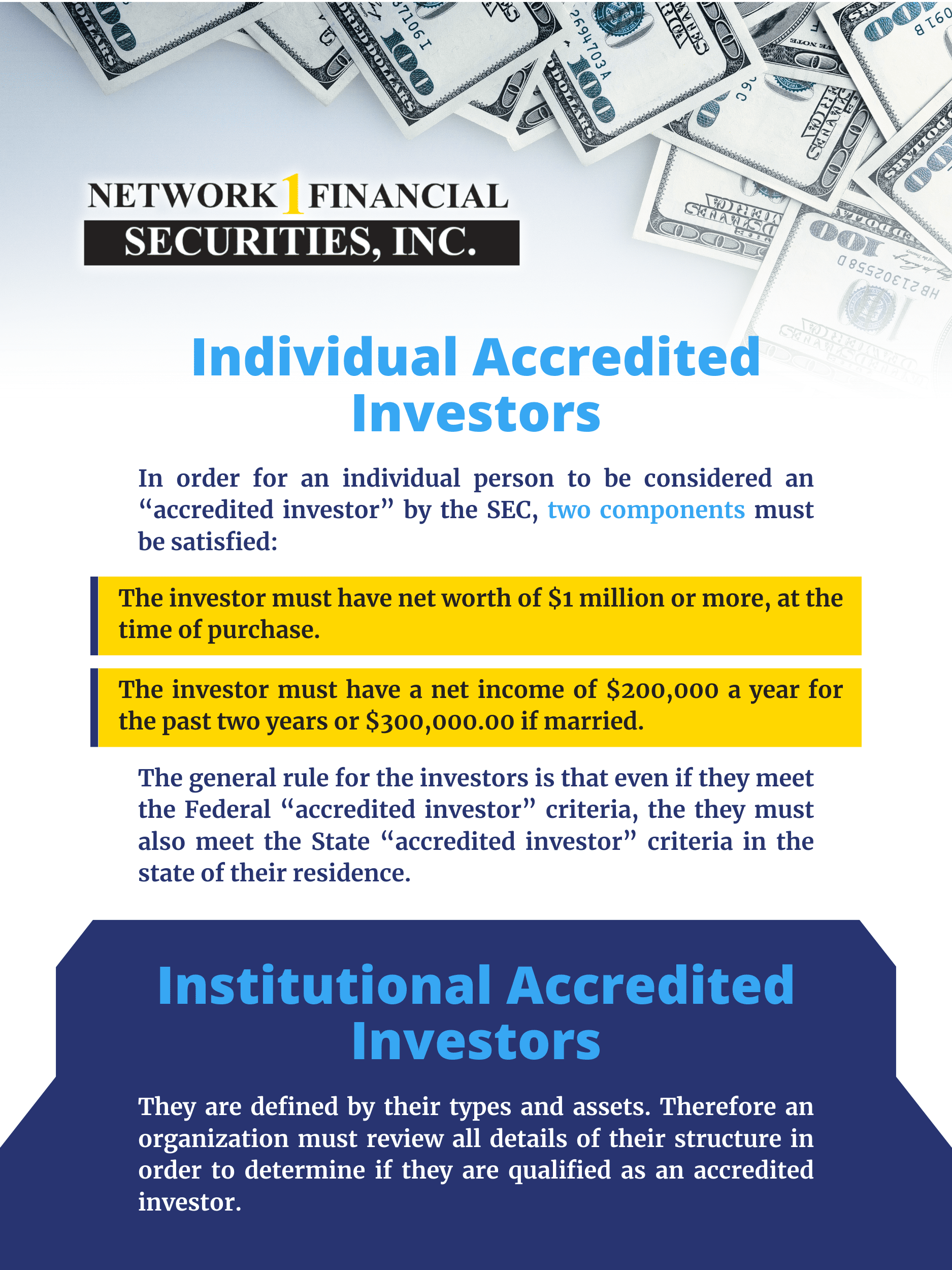

Certified investors include high-net-worth individuals, banks, insurance provider, brokers, and trust funds. Recognized financiers are specified by the SEC as certified to buy facility or sophisticated sorts of securities that are not carefully managed - accredited investor database. Specific standards need to be satisfied, such as having an average yearly income over $200,000 ($300,000 with a partner or cohabitant) or operating in the monetary market

Unregistered safety and securities are naturally riskier because they lack the normal disclosure demands that come with SEC enrollment., and different offers involving complicated and higher-risk financial investments and tools. A company that is looking for to increase a round of financing may decide to directly come close to certified capitalists.

It is not a public business however wishes to introduce a first public offering (IPO) in the future. Such a business might choose to use safety and securities to certified financiers directly. This kind of share offering is referred to as a private positioning. definition of qualified purchaser. For certified financiers, there is a high potential for risk or benefit.

Accredited Investor Solutions

The policies for certified investors vary amongst territories. In the U.S, the interpretation of a certified financier is presented by the SEC in Regulation 501 of Regulation D. To be a recognized financier, a person should have an annual earnings going beyond $200,000 ($300,000 for joint earnings) for the last two years with the assumption of gaining the exact same or a higher earnings in the existing year.

A recognized financier ought to have a net well worth going beyond $1 million, either individually or jointly with a spouse. This amount can not include a main residence. The SEC additionally considers applicants to be approved investors if they are general companions, executive police officers, or directors of a company that is releasing non listed securities.

Non Accredited Investor

If an entity consists of equity proprietors that are accredited financiers, the entity itself is a recognized capitalist. A company can not be created with the single purpose of buying particular protections. A person can qualify as an approved capitalist by demonstrating sufficient education and learning or job experience in the economic industry.

People who wish to be accredited financiers do not put on the SEC for the designation. sophisticated investor status. Rather, it is the obligation of the firm supplying a private positioning to ensure that all of those approached are accredited capitalists. People or parties who intend to be recognized investors can come close to the provider of the unregistered safeties

Qualified Investor Definition

As an example, mean there is an individual whose income was $150,000 for the last 3 years. They reported a key residence worth of $1 million (with a home loan of $200,000), a vehicle worth $100,000 (with a superior lending of $50,000), a 401(k) account with $500,000, and an interest-bearing account with $450,000.

Net well worth is calculated as possessions minus liabilities. He or she's total assets is precisely $1 million. This involves a computation of their possessions (besides their primary house) of $1,050,000 ($100,000 + $500,000 + $450,000) less an auto funding equating to $50,000. Because they fulfill the total assets need, they certify to be an accredited capitalist.

There are a few much less common certifications, such as managing a count on with more than $5 million in assets. Under federal protections legislations, just those who are certified capitalists might join specific protections offerings. These might include shares in exclusive placements, structured items, and private equity or bush funds, to name a few.

Latest Posts

How To Invest In Tax Liens

Tax Foreclosure Property Listings

What Is Tax Lien Real Estate Investing