All Categories

Featured

Table of Contents

- – Renowned Exclusive Deals For Accredited Investors

- – High-Value Accredited Investor Investment Oppo...

- – High-End Accredited Investor Crowdfunding Opp...

- – Innovative Accredited Investor Wealth-buildin...

- – Accredited Investor Platforms

- – Unparalleled Accredited Investor High Return...

- – Elite Accredited Investor Real Estate Deals

The guidelines for recognized financiers differ amongst territories. In the U.S, the definition of a recognized investor is presented by the SEC in Guideline 501 of Regulation D. To be a certified investor, an individual needs to have an annual revenue exceeding $200,000 ($300,000 for joint earnings) for the last two years with the expectation of earning the very same or a greater earnings in the existing year.

This amount can not include a main house., executive officers, or supervisors of a company that is releasing non listed securities.

Renowned Exclusive Deals For Accredited Investors

Also, if an entity consists of equity owners that are recognized capitalists, the entity itself is a recognized financier. However, a company can not be developed with the sole purpose of acquiring specific protections - Accredited Investor Opportunities. An individual can certify as an accredited financier by showing adequate education and learning or job experience in the financial market

People that wish to be approved investors don't use to the SEC for the classification. Instead, it is the duty of the company offering a personal positioning to make certain that all of those approached are approved investors. People or events that wish to be recognized capitalists can come close to the provider of the non listed safety and securities.

Expect there is a specific whose revenue was $150,000 for the last three years. They reported a key home worth of $1 million (with a mortgage of $200,000), a cars and truck worth $100,000 (with an exceptional lending of $50,000), a 401(k) account with $500,000, and a cost savings account with $450,000.

Internet worth is calculated as assets minus obligations. This individual's total assets is specifically $1 million. This includes a calculation of their assets (apart from their primary residence) of $1,050,000 ($100,000 + $500,000 + $450,000) less a vehicle loan equaling $50,000. Considering that they satisfy the total assets need, they certify to be a recognized financier.

High-Value Accredited Investor Investment Opportunities

There are a few less usual qualifications, such as managing a count on with greater than $5 million in possessions. Under government safeties legislations, only those who are approved financiers might take part in specific safeties offerings. These might consist of shares in private positionings, structured items, and exclusive equity or bush funds, among others.

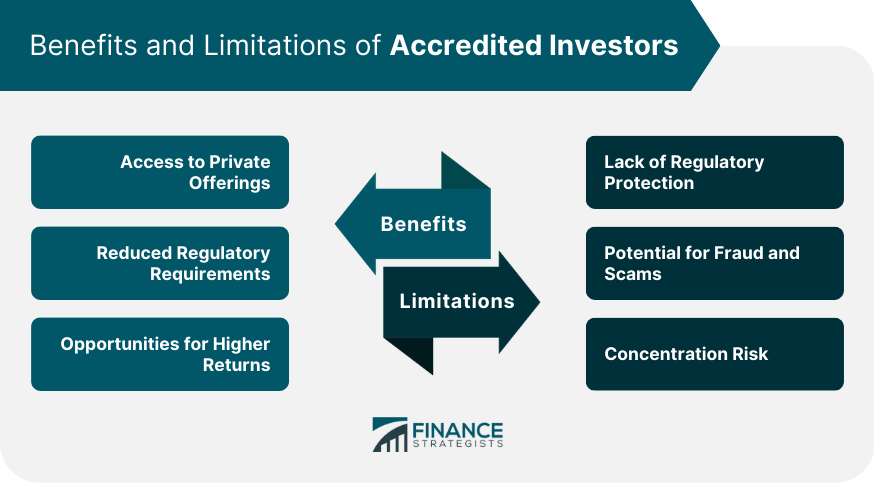

The regulators wish to be particular that participants in these highly high-risk and complicated investments can look after themselves and evaluate the dangers in the absence of federal government protection. The accredited capitalist rules are made to shield prospective capitalists with minimal financial expertise from risky ventures and losses they might be unwell geared up to endure.

Recognized capitalists satisfy credentials and professional standards to access special investment opportunities. Recognized investors need to meet earnings and web worth needs, unlike non-accredited individuals, and can invest without constraints.

High-End Accredited Investor Crowdfunding Opportunities

Some essential adjustments made in 2020 by the SEC include:. Including the Collection 7 Collection 65, and Series 82 licenses or other credentials that reveal economic know-how. This adjustment acknowledges that these entity kinds are typically used for making financial investments. This change acknowledges the proficiency that these staff members establish.

These modifications expand the certified financier swimming pool by roughly 64 million Americans. This broader access gives a lot more chances for capitalists, but likewise increases potential threats as much less economically sophisticated, financiers can take part.

One major advantage is the chance to purchase placements and hedge funds. These financial investment alternatives are special to certified investors and institutions that certify as a recognized, per SEC policies. Exclusive positionings enable firms to safeguard funds without navigating the IPO procedure and regulative documents required for offerings. This gives certified investors the opportunity to purchase arising companies at a phase before they consider going public.

Innovative Accredited Investor Wealth-building Opportunities for Exclusive Opportunities

They are seen as investments and are available only, to certified customers. Along with recognized firms, certified financiers can pick to purchase start-ups and promising ventures. This uses them tax obligation returns and the possibility to get in at an earlier phase and possibly gain benefits if the firm succeeds.

Nonetheless, for investors open to the dangers included, backing startups can cause gains. Much of today's tech companies such as Facebook, Uber and Airbnb came from as early-stage startups supported by approved angel investors. Advanced investors have the chance to explore investment options that might generate extra revenues than what public markets offer

Accredited Investor Platforms

Although returns are not ensured, diversification and profile improvement options are expanded for financiers. By diversifying their profiles with these expanded financial investment methods accredited investors can boost their methods and possibly achieve exceptional long-lasting returns with proper danger administration. Seasoned financiers often encounter financial investment choices that might not be easily available to the general capitalist.

Investment choices and safety and securities offered to certified capitalists normally involve greater threats. Personal equity, venture funding and bush funds often focus on spending in assets that lug risk yet can be liquidated conveniently for the opportunity of higher returns on those risky investments. Investigating before investing is important these in scenarios.

Lock up durations stop capitalists from taking out funds for more months and years on end. Capitalists might struggle to properly value exclusive assets.

Unparalleled Accredited Investor High Return Investments

This modification might expand recognized financier standing to a range of people. Allowing companions in committed connections to integrate their resources for shared eligibility as recognized financiers.

Allowing individuals with specific expert qualifications, such as Series 7 or CFA, to certify as certified capitalists. Creating extra requirements such as proof of monetary proficiency or effectively completing an approved financier examination.

On the other hand, it might also result in skilled capitalists presuming extreme threats that may not be appropriate for them. Existing certified financiers may face enhanced competitors for the ideal investment opportunities if the pool expands.

Elite Accredited Investor Real Estate Deals

Those that are presently considered certified financiers need to stay upgraded on any modifications to the standards and policies. Services looking for accredited financiers should stay vigilant regarding these updates to guarantee they are drawing in the ideal target market of investors.

Table of Contents

- – Renowned Exclusive Deals For Accredited Investors

- – High-Value Accredited Investor Investment Oppo...

- – High-End Accredited Investor Crowdfunding Opp...

- – Innovative Accredited Investor Wealth-buildin...

- – Accredited Investor Platforms

- – Unparalleled Accredited Investor High Return...

- – Elite Accredited Investor Real Estate Deals

Latest Posts

How To Invest In Tax Liens

Tax Foreclosure Property Listings

What Is Tax Lien Real Estate Investing

More

Latest Posts

How To Invest In Tax Liens

Tax Foreclosure Property Listings

What Is Tax Lien Real Estate Investing